Fed consensus is great; dissent is even better

- 12.12.25

- Economy & Policy

- Commentary

Chief Economist Eugenio J. Alemán discusses current economic conditions.

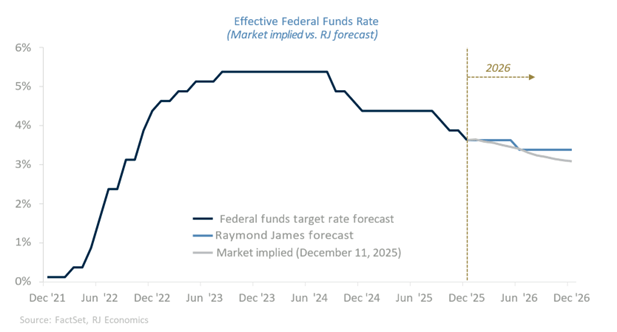

This week, the Federal Reserve’s (Fed) Federal Open Market Committee (FOMC) delivered another 25 basis point reduction in the federal funds rate in what some called a “hawkish” cut. The argument for it being a hawkish cut was because out of the three members who dissented, two of those members dissented because they wanted no cuts during the meeting. The third dissenter was highly dovish and wanted a 50 basis point cut rather than a 25 basis point cut.

Many times, criticism of the Fed has come associated with the argument that it is “a good friend’s club” exposing a “group think mentality.” However, nothing could be further from the truth with this group. Anybody that knows how economists think knows that they are always accused of being two-handed, that is, “on the one hand and on the second hand.” There have been cases when we have encountered three- or even four-handed economists, so nothing is farther from the truth that Fed officials are suffering from some sort of group think in their monetary policy decisions.

Furthermore, achieving consensus at the FOMC level is not the same thing as steadfast agreement on the decisions the committee makes, it is just a negotiated consensus after considering all of the alternatives. Thus, when that consensus is broken, it is not because the institution is broken, it is because the institution is working as it is intended to work.

We favored a rate cut at this time. However, we realize that a very good case could have been made, from a monetary policy as well as an economic point of view, for no cuts or even higher rates, although the latter alternative had a very, very high bar, as the chair of the Fed seems to have alluded to during the press conference after the FOMC decision.

In fact, we believe that Fed officials finally decided to go ahead with a rate cut as a way to buy time to get a better reading on economic activity after the delay in data releases due to the government shutdown. However, it is clear that there was an important lack of conviction that a rate cut was really needed at this time, which is why two dissenters opted for no cut in rates during the meeting.

For the majority of FOMC members, they were probably indifferent between cutting by 25 basis points or keeping rates steady, as long as markets kept upward pressure on longer term rates, as it has been the case since September of 2024, when the cycle started. Meanwhile, those preferring to keep rates unchanged were probably more concerned with inflation expectations being affected by the political pressure coming from the Trump administration to lower rates more forcefully.

Going forward, although FOMC members left the door open for another 25 basis point cut during 2026, the bar to proceed with such a cut is very, very high and would require a severe deterioration in the labor market, which is not part of our forecast nor is it embedded in the Fed forecast.

At the same time, the dissents prove that no matter who is chosen to become the new chair of the Fed, the institution will maintain its policy independence as long as political pressures do not threaten how the institution works. If we see further intervention in the Fed decision-making process coming from the political system, then all bets are off and the risks for higher inflation will skyrocket.

That is, although much lower interest rates are good in many circumstances, this is not one of those many circumstances. Inflation is still not securely heading towards the Fed’s 2% long-run target and we are probably going to see some more tariff induced price increases during 2026. Once these tariff effects subside, then the Fed will probably resume their search for the long-term federal funds rate, which they estimate to be close to 3.0%.

Economic and market conditions are subject to change.

Opinions are those of Investment Strategy and not necessarily those of Raymond James and are subject to change without notice. The information has been obtained from sources considered to be reliable, but we do not guarantee that the foregoing material is accurate or complete. There is no assurance any of the trends mentioned will continue or forecasts will occur. Past performance may not be indicative of future results.