A glance at our latest views on the economy and markets

Review the latest Weekly Headings by CIO Larry Adam.

Key Takeaways

- We expect the US economy to rebound to 2.0% in 2026

- Equity multiples are lofty, so EPS growth needs to drive further gains

- Stay focused on sectors with fundamental tailwinds

Another quarter, another record. The third quarter delivered just that—record equity price levels worldwide, gold hitting new highs, and high-grade credit spreads narrowing to multi-decade lows. Speaking of records, did you know the Guinness Book of World Records celebrated its 70th anniversary this year? From the tallest buildings to the quirkiest talents, the book’s pages are filled with jaw-dropping human achievements and downright bizarre feats. In many ways, it’s a fitting metaphor for today’s economic and market landscape: full of unexpected twists, extremes, and record-breaking moments. For more on our outlook, join us this Monday, October 6 at 4 PM ET for our 4Q 2025 Outlook: Breaking Records, Not Discipline. In the meantime, here’s a sneak peek at our latest views on the economy, markets, and what surprises may lie ahead:

- Temporary Slowdown, But US Economy Poised to Rebound | The US economy remains the global leader, but the data tells a more nuanced story—marked by both ‘jaw-dropping’ and less flattering records. On the positive side, the US is still the world’s largest economy, with household net worth at record highs and corporate profits healthy and rising. Yet record debt, affordability challenges, widening inequality, and tariffs pose risks ahead. For the rest of this year, we expect job growth to slow and tariff-driven price increases to weigh on consumer spending, causing a temporary pause in 4Q and leading to overall GDP growth of 1.8% in 2025. However, a mix of fiscal and monetary stimulus—tax cuts and Fed interest rate cuts—should revive confidence and spark a mild rebound in 2026, lifting growth to 2.0%.

- The Fed’s Difficult Balancing Act | Chair Powell is walking a fine line, balancing the Fed’s dual mandate—stable prices and full employment—which are currently at odds. Job growth has stalled and the unemployment rate has increased while tariffs are pushing prices higher, making the path forward anything but risk-free, as Chair Powell noted. Inflation remains above the Fed’s 2% target, but Powell views tariff-driven price hikes as ‘transitory’ rather than structural—a view we share. This gives the Fed room to focus on employment, with more rate cuts likely to support growth. We expect two additional cuts by year-end (October and December) and at least one more in 2026.

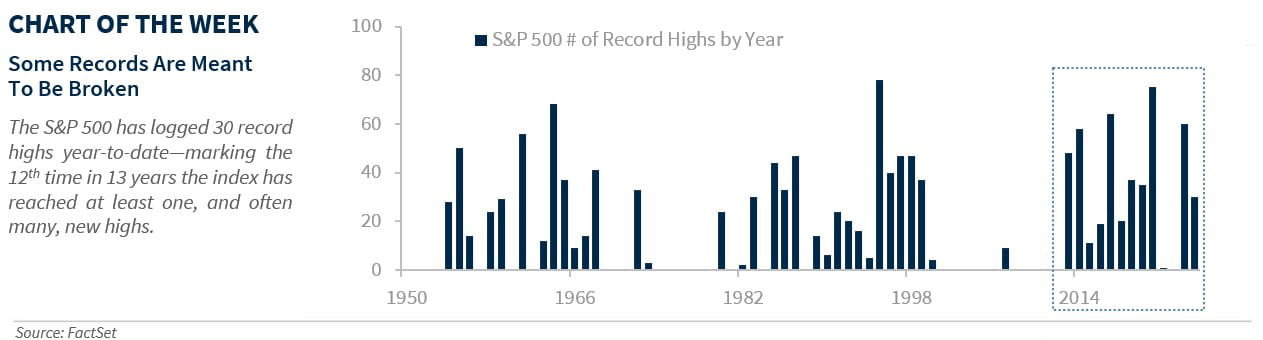

- Still Optimistic On US Equities Longer Term | Some records are meant to be broken, and equity markets—both in the US and abroad—have done just that by extending their recent gains. While we believe the bull market has more room to run, near-term caution is warranted. After an uninterrupted ~34% rally from the early April lows, the S&P 500 likely needs a breather. With economic growth slowing, tariffs weighing on margins (and likely earnings growth), and valuations stretched—S&P 500 NTM P/E sits in the 97th percentile—a consolidation phase is likely. Longer term, we remain constructive. Drivers of our optimism: rebounding economic growth, greater clarity on tariffs, and further Fed interest rate cuts. This backdrop supports our new 12-month S&P 500 target of 6,900, about 3% above current levels. However, with valuations already elevated, gains should come more from earnings growth than multiple expansion.

- Stay Focused on Sectors with Structural Tailwinds | We continue to favor sectors supported by long-term secular trends: AI infrastructure buildout, reshoring, defense spending, electrification, and aging demographics. These themes provide durable earnings tailwinds, which is why we maintain overweight positions in the Tech, Industrials, and Health Care sectors. From a size perspective, we prefer large caps over small caps. While Fed rate cuts should help smaller-cap companies, we’d like clearer signs of sustainable earnings improvement before turning more positive. Geographically, we remain firmly US-focused over other developed markets like Europe and Japan. Stronger economic and earnings growth, greater innovation, and elevated tech exposure reinforce our view that US exceptionalism remains intact.

- Slow And Steady Gains In Fixed Income | In fixed income, the story is more about consistency than spectacle. With interest rates still elevated relative to their recent past, it’s a good time for investors to harvest income. As the Fed continues to cut interest rates, we expect short-term Treasury yields to move lower, while the 10-year Treasury yield is expected to drift higher to 4.25%-4.50%. With cash yields starting to decline, investors may want to consider reallocating some of their ‘excess’ cash opportunistically. Despite persistent fiscal concerns, buyers have not shied away from Treasuries; demand, both at home and abroad, remains strong. From a sector perspective, we continue to favor investment-grade corporates and municipals for their balance of quality and income. While credit spreads are trading at historically tight levels, we expect them to remain stable—allowing investors to capture still-attractive yields.

- Disciplined Asset Allocation | When it comes to asset allocation, one principle stands above the rest: discipline matters. Market highs are exciting, but they’re not always signals to chase performance. And downturns? Not a reason to panic. Rebalancing keeps your portfolio aligned with your risk tolerance. It’s your investment GPS—keeping you on course, even when markets and headlines tempt you to veer off.

All expressions of opinion reflect the judgment of the author(s) and the Investment Strategy Committee, and are subject to change. This information should not be construed as a recommendation. The foregoing content is subject to change at any time without notice. Content provided herein is for informational purposes only. There is no guarantee that these statements, opinions or forecasts provided herein will prove to be correct. Past performance is not a guarantee of future results. Indices and peer groups are not available for direct investment. Any investor who attempts to mimic the performance of an index or peer group would incur fees and expenses that would reduce returns. No investment strategy can guarantee success. Economic and market conditions are subject to change. Investing involves risks including the possible loss of capital.

The information has been obtained from sources considered to be reliable, but we do not guarantee that the foregoing material is accurate or complete. Diversification and asset allocation do not ensure a profit or protect against a loss.