Fixed income solutions

Doug Drabik discusses fixed income market conditions and offers insight for bond investors.

The Federal Reserve is entrenched in its struggle between its two mandates. They are charged with keeping stable pricing in the markets and striving toward maximum employment.

There appears to be some cracks in employment strength. Nonfarm Payrolls, which measures the number of jobs added or lost in the economy, has shown diminishing strength, falling well below averages in each of the last four monthly reports. Still, the overall unemployment rate stands at 4.3%, below the long-term target of 5%. The net level of employment remains favorable, yet the negative directional trend gives the Fed and investors pause for concern.

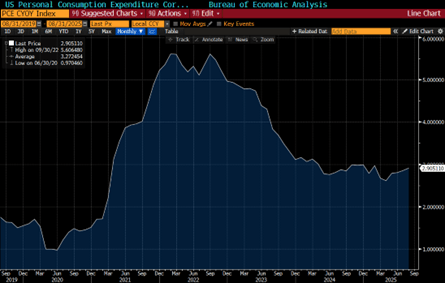

Excessive inflation disrupts the ability to maintain stable pricing. Inflation, triggered by the pandemic, most recently peaked in September 2022. Inflation dropped precipitously from 2023 to mid-2024. There it stalled and has ticked higher in each of the last four months. Inflation, as measured by the Core Personal Consumption Expenditure (PCE) index, has yet to reach the Fed’s target of 2.0% and currently stands at 2.91%.

Let’s be clear that inflation affects all people and all assets. It is easy to pinpoint the adverse effects inflation has on fixed income investments because the math is evident; however, inflation impacts every dollar spent on stocks, every dollar spent on a house, every dollar spent on food, and so on. There is no place to hide from inflation, so don’t be misled by catchphrases or slanted biases. Inflation, as it often is implied, does not take your wealth. It is a reduction of purchasing power that may slow/reduce certain purchases or the impact of your spending power. Eventually, it can reduce your standard of living by preventing you from buying all the desired/essential goods or services.

One of the most potent methods that the Fed possesses to combat inflation is its ability to raise the Fed Funds rate. Higher interest rates make borrowing more difficult for businesses and consumers, encourage saving, and discourage spending, thus slowing down the economy. However, restrictive policy is what the Fed is moving away from with its current cuts in the Fed Funds rate. This is their dilemma between curbing inflation and adopting a more neutral policy position that better suits helping employment and encouraging spending.

The argument exists that the Fed is limited in its ability to impact inflation. Regardless of the unemployment rate, if the economy is slowing while inflation remains elevated, there is a possibility of stagflation. The negative employment direction helps to fuel this argument. If the Fed raises rates high enough, it risks slowing economic output. If the Fed continues to lower rates, it risks stimulating inflation.

Inflation is ugly, as it reduces access to products and services by reducing purchasing power. Selling bonds to buy growth assets in hopes of mitigating inflation does not change the impact of inflation on invested dollars and may position an investor to take on other risks. This will ultimately depend on the overall economic health, as it is navigated by Fed and government policies.

The author of this material is a Trader in the Fixed Income Department of Raymond James & Associates (RJA), and is not an Analyst. Any opinions expressed may differ from opinions expressed by other departments of RJA, including our Equity Research Department, and are subject to change without notice. The data and information contained herein was obtained from sources considered to be reliable, but RJA does not guarantee its accuracy and/or completeness. Neither the information nor any opinions expressed constitute a solicitation for the purchase or sale of any security referred to herein. This material may include analysis of sectors, securities and/or derivatives that RJA may have positions, long or short, held proprietarily. RJA or its affiliates may execute transactions which may not be consistent with the report’s conclusions. RJA may also have performed investment banking services for the issuers of such securities. Investors should discuss the risks inherent in bonds with their Raymond James Financial Advisor. Risks include, but are not limited to, changes in interest rates, liquidity, credit quality, volatility, and duration. Past performance is no assurance of future results.

Investment products are: not deposits, not FDIC/NCUA insured, not insured by any government agency, not bank guaranteed, subject to risk and may lose value.

To learn more about the risks and rewards of investing in fixed income, access the Financial Industry Regulatory Authority’s website at finra.org/investors/learn-to-invest/types-investments/bonds and the Municipal Securities Rulemaking Board’s (MSRB) Electronic Municipal Market Access System (EMMA) at emma.msrb.org.