Key developments to watch that may lead to increased volatility

- 08.08.25

- Markets & Investing

- Commentary

Review the latest Weekly Headings by CIO Larry Adam.

Key Takeaways

- The Fed confronts a dilemma as hiring slows while inflation heats up

- Sectoral tariffs on pharma and semis may come as early as next week

- In tech and elsewhere, some bellwethers will report in the coming weeks

Summer Lull or Summer Surprise? That’s the big question on investors’ minds as we enter what’s typically a quieter stretch for the financial markets. With many traders and analysts on vacation, Congress in recess, no major central bank meetings scheduled, and second-quarter earnings season winding down, it’s easy to expect fewer ‘market-moving’ headlines. But August’s calm reputation can be deceiving—history has delivered big surprises, from Iraq’s invasion of Kuwait in 1990 to Russia’s default in 1998 and the US credit rating downgrade in 2011. More recently, Chair Powell’s hawkish, inflation-focused Jackson Hole speech in 2022, leading to aggressive Fed interest rate hikes and last year’s unwinding of the yen carry trade, sparked volatility. Yet so far this August, even a weak payrolls report and new tariff announcements haven’t shaken the equity rally, with the S&P 500 just 1% below its all-time high. Below, we highlight five key developments we’re watching that could trigger increased volatility before summer ends:

- Inflation: When Will It Start To Run ‘Hotter’? | Investors are watching closely as tariffs threaten to push inflation higher, but so far, the impact has been limited. While prices have ticked up in select categories—like appliances, tools, toys, and household furnishings—those increases have largely been offset by declines in others, including airfares, new vehicles, lodging, and shelter costs. This suggests one of two things: either it’s too early to see the full effect, with pre-tariff inventory cushioning the blow, or weaker demand is dampening the pass-through. Still, signs of rising price pressures are emerging. Regional Fed and ISM surveys show an uptick in price pressures, with the ISM Services Prices Index hitting a three-year high this week—raising concerns among Fed officials. Next week’s CPI and PPI reports may not resolve the key question: are tariffs causing a one-time bump in prices, or something more persistent? With newly increased country-level tariffs taking effect yesterday, the Fed may not have the luxury of waiting for clarity—especially if growth continues to slow.

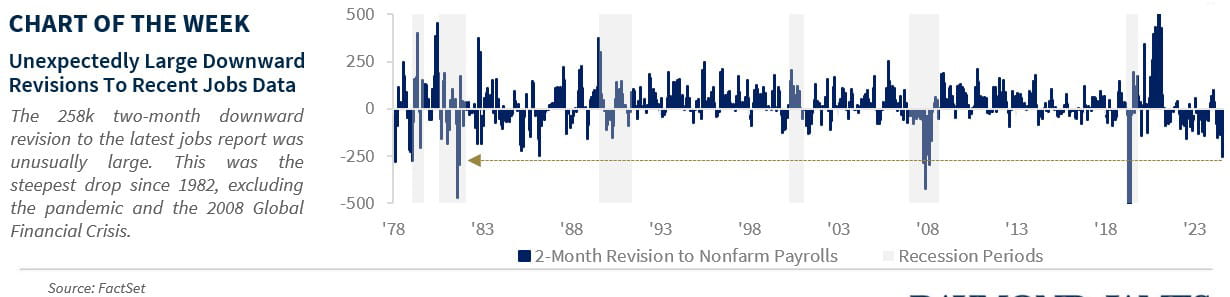

- Jobs: ‘Cooling’ Labor Is A Growing Risk | The July jobs report came in weaker than expected. Sharp downward revisions erased 258k jobs from the prior two months—the steepest drop since 1982, excluding the pandemic and 2008 Global Financial Crisis—bringing the three-month average for job growth down to just 35k. Fed Chair Powell and New York Fed President Williams have maintained that the labor market remains solid, citing the low and steady unemployment rate (between 4.0% and 4.2% over the past 15 months) as evidence of balanced labor supply and demand. Initial jobless claims also haven’t shown signs of sustained weakness. Still, downside risks are becoming more visible. Employment components in the ISM surveys have slipped further into contraction, and the number of long-term unemployed (27 weeks or more) has climbed above 1.8 million—the highest since 2017, excluding COVID. Any further signs of softening in upcoming labor data—such as initial claims, JOLTS, or survey-based indicators—could tilt the Fed toward a rate cut in September.

- Fed: Potential ‘Fireworks’ Ahead Of The Next Meeting | The Fed’s dual mandate—price stability and full employment—is making decision-making more complex. Growth has slowed and the labor market has weakened, while tariffs are gradually pushing prices higher. As policymakers wait for more clarity, pressure is mounting—from both the White House and within the Fed. Two dissenters at the last meeting argued for an immediate rate cut, though most voting members weren’t ready to move. However, the soft July jobs report has shifted the conversation, with several officials (including Cook, Daly, and Kashkari) now appearing more sympathetic to the dissenters’ concerns. Adding to the dovish tilt, Adriana Kugler’s early departure has brought a new, more accommodative voice to the Board. Keep an eye on Powell’s remarks at the Jackson Hole Symposium (August 21–23)—a forum often used to signal major policy shifts.

- Tariffs: More ‘Waves’ Are Ahead | With the new country-level tariffs—ranging from 10% to 50%—taking effect this week, markets breathed a sigh of relief that much of the uncertainty is now behind them. But more tariff action may be coming. As early as next week, the White House could announce new sector-specific tariffs on semiconductors and pharmaceuticals. For context: in 2024, the US imported $486 billion in electronics (including semiconductors) and $247 billion in pharmaceuticals, accounting for 15% and 7% of total imports, respectively. While President Trump has floated a 100% tariff on semiconductors, broad carve-outs could soften the impact of that headline rate. Meanwhile, he’s signaled that the pharma tariff will start low and rise gradually. Given that Tech and Health Care are high-value sectors, companies are likely to pass most of the cost on to consumers. One more wildcard: a legal challenge to President Trump’s use of emergency powers to impose country-level tariffs could add fresh uncertainty if a court ruling is issued soon.

- Earnings: A Few Major Reports Still On ‘Deck’ | While the 2Q25 earnings season may be winding down, there are still a handful of bellwether companies that will report their results before the end of August. Key to watch: Cisco (August 13)—a proxy for telecom capex; Home Depot (August 19) and Walmart (August 21)—for insights into how consumer spending is holding up; and, most notably, Salesforce and Nvidia (August 27)—for signals on the AI megatrend. With MAGMAN* stocks contributing nearly half of the S&P 500’s gains since the April 8 lows—Nvidia’s results could be pivotal in sustaining the index’s positive earnings and performance momentum.

All expressions of opinion reflect the judgment of the author(s) and the Investment Strategy Committee, and are subject to change. This information should not be construed as a recommendation. The foregoing content is subject to change at any time without notice. Content provided herein is for informational purposes only. There is no guarantee that these statements, opinions or forecasts provided herein will prove to be correct. Past performance is not a guarantee of future results. Indices and peer groups are not available for direct investment. Any investor who attempts to mimic the performance of an index or peer group would incur fees and expenses that would reduce returns. No investment strategy can guarantee success. Economic and market conditions are subject to change. Investing involves risks including the possible loss of capital.

The information has been obtained from sources considered to be reliable, but we do not guarantee that the foregoing material is accurate or complete. Diversification and asset allocation do not ensure a profit or protect against a loss.