Exploring the sources of consumer frustration

- 12.12.25

- Markets & Investing

- Commentary

Review the latest Weekly Headings by CIO Larry Adam.

Key takeaways

- 56% of Americans say that the cost of living is the nation’s top issue

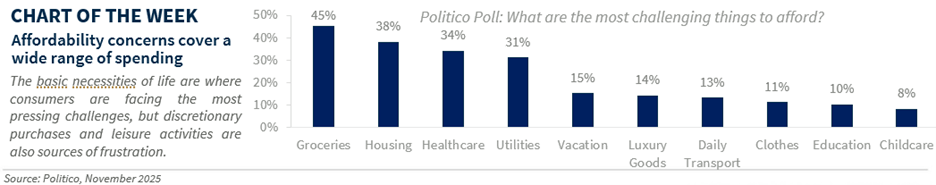

- Groceries, housing, healthcare and utilities are all sources of frustration

- Recent election results suggest that Democrats are benefiting from voter anger

The Federal Reserve wrapped up its final meeting of 2025, delivering – as expected – its third consecutive rate cut. Policymakers lowered the fed funds rate to a target range of 3.5% to 3.75%, signaling continued support for the economy. However, deep divisions within the Fed mean that additional cuts are far from assured. Chair Jerome Powell emphasized that monetary policy now sits within a broad range considered “neutral” – code word for the Fed is shifting to a wait-and-see approach and monitoring how economic conditions unfold in the months ahead. This pivot is unlikely to sit well with President Donald Trump, who has repeatedly called for sharply lower rates. But two structural challenges – persistent affordability pressures and increasingly bifurcated consumer – cannot be solved simply by cutting rates further. These issues will continue to shape the narrative for both the Fed and lawmakers as we move into 2026. Below, we explore some of the key affordability issues and offer an early perspective on the political landscape as the midterms draw closer.

What are consumers’ top cost-of-living frustrations?

According to a Politico poll from November, 56% of Americans look at the high cost of living as the top issue facing the nation – nearly 3x more than crime or immigration. While inflation has moved sharply lower – currently 3.0% - after peaking near 9% in June 2022, price levels across a wide variety of goods and services remain significantly higher compared to pre-pandemic price levels. Below, we list the four biggest areas where affordability concerns are the greatest:

- Groceries: Topping the list of concerns for Americans are food prices, with 45% of those surveyed noting that groceries are “the most challenging thing to afford.” While aggregate grocery price inflation is moderate – up 2.7% year over year in September – certain products have seen a sharper escalation, items such as coffee (+18.9%), beef (+14.7%) and candy (+9.8%). Tariffs haven’t helped. This has emerged as a political issue – a common theme since the pandemic – but is not something that can be directly addressed via monetary policy since food prices are driven by supply factors – weather, crops, fertilizer costs, labor – whereas rate changes will impact demand.

- Housing: Housing affordability continues to rank among the top concerns for Americans, clocking in at 38%. There is bipartisan agreement on this issue, but many of the key policies (e.g., zoning rules) are local, and have led to a chronic housing shortage. While house prices are rising at their slowest pace since mid-2023 – up 1.4% year over year in September – Americans have been pushed out of the market as home prices have surged nearly 50% from pre-COVID levels. Elevated mortgage rates have compounded the affordability issue. While the overall homeownership rate has remained steady in the mid-60% range, it’s only 35% for individuals under 35. Unsurprisingly, the typical age of the first-time home buyer has climbed to an all-time high of 40 years – also a worrisome trend.

- Healthcare: This remains a chronic frustration, with 34% highlighting healthcare costs as their main concern. With demand on the rise amid an aging population, supply has struggled to keep up. Healthcare spending accounts for 18% of GDP, by far the highest among the G7 countries, and is likely to increase further. Of more immediate importance, if the federal health insurance subsidies expire at year-end, which seems likely, at least 22 million Americans will see much higher premiums in 2026. Party line conflict over this issue could lead to another government shutdown in January, and it’s poised to be a key issue in the midterms.

- Utility bills: Electric bills have supplanted gasoline as the energy issue that consumers are worried about. With the data center buildout causing electricity demand to grow at the fastest rate in two decades, power prices are outpacing overall inflation in 2025, and we expect this trend to continue in 2026. Congressional analysis estimates that the average household paid $100 more in 2025 than in 2024, with a handful of states seeing price hikes of $250+.

Is the ‘K’ shaped consumer morphing into an ‘I’?

Consumer spending has become deeply uneven since the pandemic. Affluent households, benefiting from soaring asset prices and strong wage gains, continue to spend on luxury goods and experiences, while lower-income cohorts are losing ground as higher everyday costs have forced many to tighten their budgets and pull back on discretionary purchases. Furthermore, middle-income consumers are now getting squeezed – not keeping pace with their more affluent peers, but also not benefiting from the social safety net. It’s no wonder that consumer confidence remains depressed – the latest University of Michigan sentiment survey is at levels last seen (and only briefly) in 2022. This dynamic was on full display during last quarter’s earnings season with many retailers, discount stores in particular, noting that even wealthier consumers are seeking better value and cost savings. From an economic standpoint, the economy is increasingly reliant on the top 10% of households – creating an unhealthy imbalance.

How will affordability challenges influence the political landscape?

Whenever voters are frustrated, they tend to punish the party in power. Democrats experienced that in 2024, and now Republicans are facing similar pressure, given they currently control Congress and the White House. The off-year elections last month favored Democrats, and the same has been true of the various special elections. While there is still nearly 11 months until the midterms, early signs suggest the probability of a “blue wave” is growing – with the big question being how potent it will be. While the headline rate of inflation should decelerate once tariff impacts fade, this does not mean that prices will actually come down. As a result, affordability and cost-of-living concerns are likely to be a defining issue for most voters in the midterm elections.

All expressions of opinion reflect the judgment of the author(s) and the Investment Strategy Committee and are subject to change. This information should not be construed as a recommendation. The foregoing content is subject to change at any time without notice. Content provided herein is for informational purposes only. There is no guarantee that these statements, opinions or forecasts provided herein will prove to be correct. Past performance is not a guarantee of future results. Indices and peer groups are not available for direct investment. Any investor who attempts to mimic the performance of an index or peer group would incur fees and expenses that would reduce returns. No investment strategy can guarantee success. Economic and market conditions are subject to change. Investing involves risks including the possible loss of capital.

The information has been obtained from sources considered to be reliable, but we do not guarantee that the foregoing material is accurate or complete. Diversification and asset allocation do not ensure a profit or protect against a loss.