The Fed appears poised to restart its rate-cutting cycle

Review the latest Weekly Headings by CIO Larry Adam.

Key Takeaways

- After a nine-month pause – the Fed will resume rate cuts next week

- The Fed still faces a balancing act – with sluggish job growth and rising inflation

- Much of the good news is largely priced into financial markets

“When the facts change, I change my mind.” That famous quote—often linked to economist John Maynard Keynes—feels especially relevant now as we look at the Federal Reserve’s current stance. Despite growing pressure from the White House to cut interest rates, the Fed has held steady this year. Why? Most policymakers (aside from the two outliers, Waller and Bowman) believed the job market was still strong. That gave them breathing room to watch how inflation might respond to new tariffs—which, so far, haven’t had a big impact. But the story shifted recently. Sharp downward revisions to job data and recent softness in the monthly data have changed the outlook. Now, after a nine-month pause, the Fed is poised to restart its rate-cutting cycle next week. What matters to investors is what the Fed signals about the path ahead. Here’s what we expect:

- A Fed Rate Cut Next Week Is A Near Certainty | Signs of weakness in the job market have started to emerge, leading Chair Powell to hint at possible rate cuts during his Jackson Hole speech in late August. Recent data has reinforced those concerns. Still, the Fed faces a balancing act—addressing those labor concerns while keeping an eye on a potential short-term bump in inflation.

- Updated Economic Projections—The latest jobs data tells a very different story than what we've heard in recent months. The three-month average has slowed to just 29k new jobs, and a staggering 911k jobs were wiped from the books in the year ending March 2025 after the recent revisions. That’s a sharp contrast to the Fed’s earlier view of a strong, resilient labor market. Now, job growth is running well below the Fed’s breakeven rate—the level needed to keep unemployment steady. So, while the Fed is unlikely to revise its unemployment forecasts (still penciled in at 4.5% for both 2025 and 2026), the recent slowdown reinforces its cautious stance. After cutting growth projections last quarter (2025: 1.4%, 2026: 1.6%), big changes aren’t expected. But with fresh stimulus from President Trump’s 'One Big Beautiful Bill,' easing tariff concerns, and rate cuts likely on the horizon, we’ll be watching closely to see if 2026 GDP gets a lift. As for inflation, tariff-related price pressures are creeping in—but more slowly than expected. The Fed seems willing to look past these temporary bumps, especially if inflation expectations stay anchored. So, expect it to keep using the word ‘transitory.’

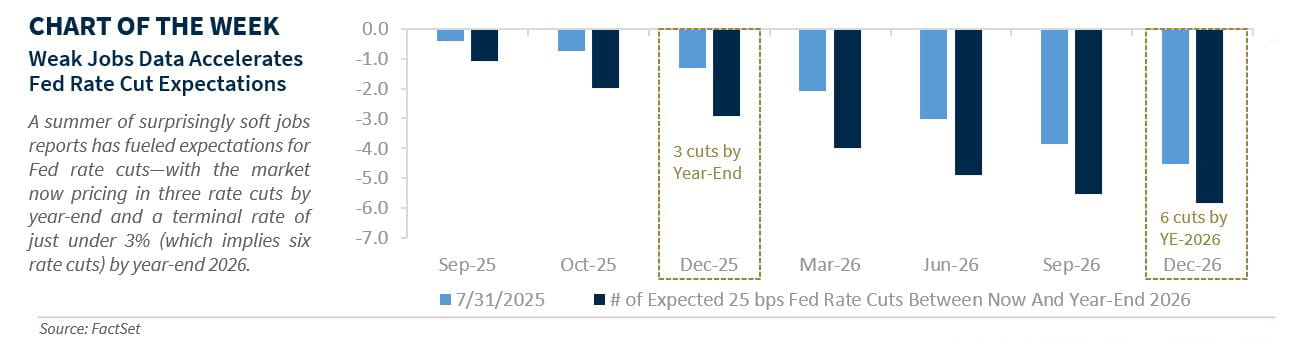

- New Dot Plot—Sluggish job growth has fueled expectations for Fed rate cuts, with markets now pricing in nearly three cuts by year-end and a terminal rate just under 3% by the end of 2026. While chatter about a larger 50 bp cut next week has picked up (odds now at 13%), it’s still a long shot—especially since seven of the nineteen Fed officials projected no cuts at all last quarter. Meanwhile, inflation remains sticky in the near term. Headline CPI rose 0.4% last month—its biggest jump this year—keeping it above the Fed’s 2% target and reinforcing concerns about inflation’s staying power. Looking ahead, the Fed’s 2026 rate outlook (median dot currently at 3.6%) could shift lower, especially with a more dovish tilt expected in its ranks (Miran’s confirmation could be key). But there’s a chance the new projections won’t match the market’s optimism—leaving Chair Powell to carefully thread the needle during his press conference.

- Asset Class Implications | Below is what the Fed’s potential economic forecast revisions and its resumption of rate cuts could mean for both the stock and bond markets in the months ahead.

- Equities—Stocks continued their climb into record territory this week, with the S&P 500 up ~13% year-to-date and hitting its 24th record high of 2025. With the Fed expected to restart rate cuts next week, one question keeps coming up: “Why should the Fed cut rates when the market is at all-time highs?” It’s a fair question—but not an unusual scenario. Historically, a significant number of interest rate cuts have happened within months of market peaks. In fact, since 1980, when the Fed cut rates after a six-month pause, the S&P 500 gained ~14% on average over the following year. That said, the outcome depends heavily on the broader economy: the S&P 500 rose ~17% when a recession was avoided, but only ~4% when one followed. We don’t expect a recession, but we also don’t see a major equity rally from here, at least in the short term. The reason: with valuations sitting in the 96th percentile over the past 20 years, much of the good news—like expected Fed cuts, trade deals, and tax policy—is already priced in. A period to digest recent gains is more likely.

- Fixed Income—With interest rates trending lower recently, there’s limited room for big gains in bond prices from here—assuming the economy avoids a recession, which remains our base case. While recent growth concerns could temporarily push the 10-year Treasury yield below 4%, that dip likely won’t hold given the fiscal backdrop and ongoing record issuance. As the Fed prepares to restart rate cuts next week, short-term rates are likely to fall, making cash less appealing for investors. Bottom line: In the months ahead, income will be the key driver of returns—helping smooth out portfolio volatility if growth ends up softer than expected.

All expressions of opinion reflect the judgment of the author(s) and the Investment Strategy Committee, and are subject to change. This information should not be construed as a recommendation. The foregoing content is subject to change at any time without notice. Content provided herein is for informational purposes only. There is no guarantee that these statements, opinions or forecasts provided herein will prove to be correct. Past performance is not a guarantee of future results. Indices and peer groups are not available for direct investment. Any investor who attempts to mimic the performance of an index or peer group would incur fees and expenses that would reduce returns. No investment strategy can guarantee success. Economic and market conditions are subject to change. Investing involves risks including the possible loss of capital.

The information has been obtained from sources considered to be reliable, but we do not guarantee that the foregoing material is accurate or complete. Diversification and asset allocation do not ensure a profit or protect against a loss.