12 wishes for the economy and markets

Review the latest Weekly Headings by CIO Larry Adam.

Key takeaways

- Fading uncertainty and fiscal tailwinds should lift us economic growth

- Weak labor trends unlikely to morph into a sharper downturn

- Solid earnings growth and a resilient economy should support us equities

Before we turn the page on 2025, let’s take a moment to reflect on the key trends that shaped the economy and financial markets this year. Despite heightened policy uncertainty and persistent geopolitical tensions, both proved remarkably resilient. Strong corporate earnings and AI enthusiasm propelled the S&P 500 to its third consecutive year of double-digit gains (+16.6% YTD), while slowing – but still positive – economic growth and timely Federal Reserve rate cuts pushed Treasury yields lower.

As we prepare to unveil our Ten Themes for 2026, featuring asset class views and actionable ideas, we’re closing out the year with 12 aspirational wishes for macro developments that, if realized, could set the stage for a thriving economy and positive financial markets in the year ahead.

Let’s review our 12 wishes:

- One United States forevermore: Despite today’s heightened political discourse, we remain hopeful that America’s 250th birthday – a historical milestone honoring the Declaration of Independence – will serve as a moment to bring people together. We hope this patriotic celebration inspires all Americans to reflect on our shared values and unify the nation.

- Two percent (or more) economic growth: Tariff turmoil could have derailed growth in 2025, but the economy proved more resilient than expected. While business uncertainty and softer hiring led to a modest slowdown, some timely Fed rate cuts and the upcoming tax cuts in the One Big Beautiful Bill Act (OBBBA) should help put growth back on a stronger track in 2026.

- An unemployment rate that starts with a three: The unemployment rate has climbed to a four-year high of 4.6% amid sluggish hiring trends. While a low-hire, low-fire environment may persist, the Fed has stepped in to provide support to prevent a sharper downturn. As uncertainty fades, and the tailwinds of the OBBBA take hold, renewed business confidence could spark a rebound in hiring in the new year.

- The bull market extends past year four: Historically, returns in the third year of a bull market have been modest, averaging just 2.5%. However, year three of this bull market has been a strong one, fueled largely by strength in mega-cap tech. With resilient economic growth, fiscal tailwinds, a supportive Fed and robust corporate earnings, the macro backdrop suggests this bull market still has room to run.

- Dow climbs to 50,000: The Dow Jones Industrial Average has continued its record-breaking winning streak, posting 18 new highs in 2025, its 13th consecutive year with at least one new record high. While 2026 gains may be more modest, earnings tailwinds from tax cuts, deregulation, and lower borrowing costs could keep the streak alive for another year.

- Oil prices stay under $60 per barrel: Oil prices (WTI) have dropped to a four-year low of $56/barrel, pushing the national average of retail gasoline price below $3/gallon, as global supply continues to outpace demand. With affordability issues top of mind heading into the midterm elections, we hope prices stay under $60/barrel, offering consumers some welcome relief at the pump.

- Long-dated municipal yields shine: Record issuance and concerns about the tax-exempt status of municipal bonds were key challenges in 2025, driving a sharp steepening in the yield curve. While debt and deficit dynamics have made investors cautious on longer maturities, tax-equivalent yields above 7% for high-income earners remain highly attractive.

- Investment grade spreads remain under 80 bps: Corporate bond spreads continue to hover near historic lows as the macro backdrop remains supportive. Strong fundamentals – healthy balance sheets, rising earnings, improving interest coverage – should provide a solid foundation for investors to seek attractive yields. Looking ahead, we wish for spreads to remain stable in 2026.

- Small business loan rates stay under 9%: Since the pandemic, small business optimism has been dampened by tighter lending standards and elevated shorter-term financing rates. While the average borrowing rate for small businesses remains above its longer-term average of 6.8%, it has declined significantly from its 2024 peak above 10%. Our hope for 2026 is this downtrend continues.

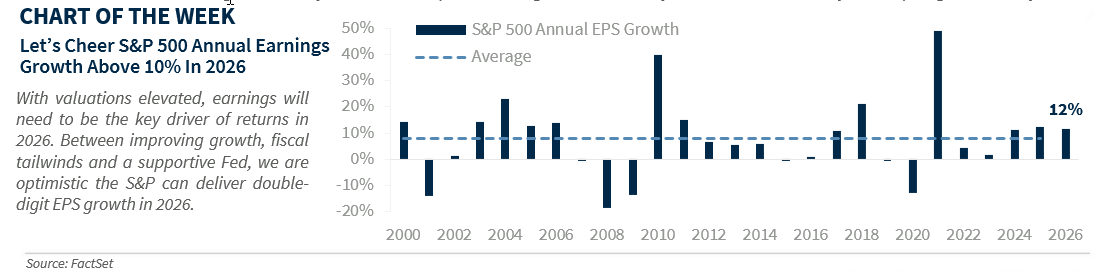

- S&P 500 earnings growth above 10%: S&P 500’s 2025 earnings proved resilient in a volatile year, delivering double-digit growth despite a range of sector-specific headwinds and rising input costs. Mega-cap tech, once again, led the charge. But with valuations now elevated, earnings will need to do the heavy lifting from here. A 10% EPS increase in 2026 would market another year of above-trend growth.

- All eleven sectors in positive territory: Three consecutive years of double-digit gains has been grand for investors, with all eleven sectors of the S&P 500 participating in the rally. As optimism builds heading into 2026, we hope this broad-based momentum persists.

- Twelve months of improving consumer confidence: Pessimism among consumers has been entrenched since the pandemic. While confidence is hovering near multi-year lows, we hope that fading tariff uncertainty and tax cuts on the way will help brighten the day.

All expressions of opinion reflect the judgment of the author(s) and the Investment Strategy Committee and are subject to change. This information should not be construed as a recommendation. The foregoing content is subject to change at any time without notice. Content provided herein is for informational purposes only. There is no guarantee that these statements, opinions or forecasts provided herein will prove to be correct. Past performance is not a guarantee of future results. Indices and peer groups are not available for direct investment. Any investor who attempts to mimic the performance of an index or peer group would incur fees and expenses that would reduce returns. No investment strategy can guarantee success. Economic and market conditions are subject to change. Investing involves risks including the possible loss of capital.

The information has been obtained from sources considered to be reliable, but we do not guarantee that the foregoing material is accurate or complete. Diversification and asset allocation do not ensure a profit or protect against a loss.