Is the equity market losing steam?

Review the latest Weekly Headings by CIO Larry Adam.

Key Takeaways

- Despite the recent court ruling, we expect tariffs to stick around

- Government shutdowns have historically not stopped the equity rally

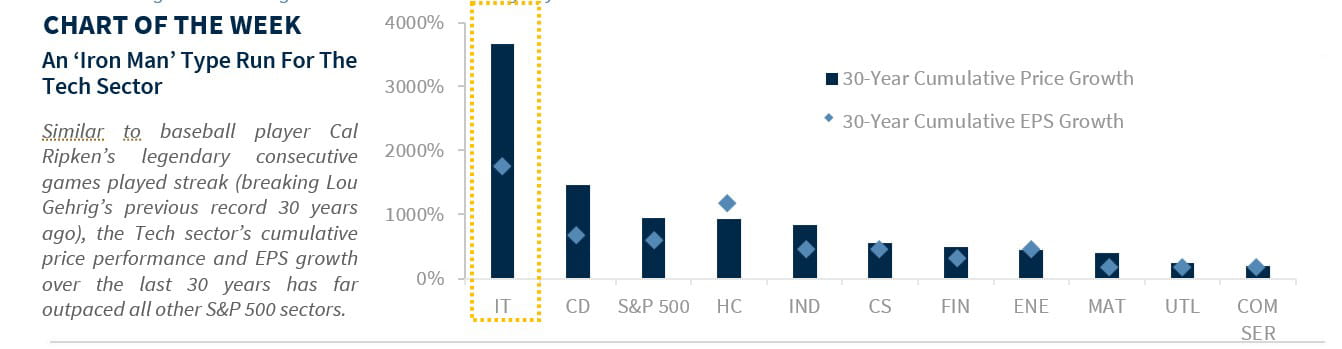

- Similar to Cal Ripken’s streak, tech’s 30-year run is one for the record books

As summer fades and the first hints of fall appear, football fans have reason to celebrate – the new season officially kicked off last night. But while excitement builds on the field, the equity market may be losing steam. After posting a stellar +12% return – its third-best summer in nearly 40 years – and experiencing unusually low volatility (just a 2.4% drawdown versus the typical 7%), the S&P 500 is beginning to show signs of choppiness. That’s not surprising – September has historically been the toughest month for markets, with average returns of –0.7% and gains only 44% of the time since 1950. With the S&P above our 12-month target of 6,375, and valuations in the 96th percentile, we are cautious in the near term and expect headlines to stir volatility. Still, pullbacks are normal market behavior – typically three to four declines of >5% each year – and we view them as potential buying opportunities, since many current risks may prove short-lived.

- The state of jobs | With job growth slowing to a stall speed of just 29k over the last 3 months, next week’s BLS data revisions could see a hefty number of jobs vanish (the Fed’s Waller estimates up to 60k/month) from previously reported stats. Does this signal a recession?

Our view: We don’t envision a recession ahead, though we do expect growth to slow in the second half of 2025. A sharp downward revision in job numbers—potentially 500,000 or more—would suggest hiring had been cooling before April. These BLS revisions reflect data through March and come as trailing three-month job growth is in its weakest stretch since 2010, ex-COVID. A steep revision could intensify concerns about the economy and bring forward expectations for rate cuts. We are already forecasting two cuts this year, with the first in September. Looking ahead, we expect the economy to rebound in 2026, helped by Fed easing and OBBB stimulus.

- Threats to Fed independence | Escalating threats to the Fed’s independence have not elicited a market reaction since President Trump fired Fed Governor Cook amid allegations of mortgage fraud. With the legal case now underway, is the market too calm given the risks?

Our view: We don’t think so. Betting markets give just a 27% chance that President Trump will succeed in removing Fed Governor Cook by year-end. The allegations remain unproven, with no formal charges filed. The Supreme Court has affirmed the Fed’s special status, meaning the legal bar for dismissal is high, albeit still unclear. Importantly, her exit wouldn’t alter the outlook for rate cuts, as she was already viewed as a policy dove. After several overreactions this year—from tariffs to deportations—the market seems to be taking a ‘wait and see’ approach.

- Tariff uncertainty | A series of trade deals helped drive strong summer market gains. Deals with Europe and Japan brought commitments of $1.1t in investment to the US and easing tensions with China gave businesses more tariff clarity—previously a drag on hiring and capex. But a recent court ruling that country-level tariffs violate IEEPA has injected fresh question marks into the trade policy outlook.

Our view: The White House is appealing the tariff ruling to the Supreme Court. In the meantime, existing tariffs remain in place. Even if overturned, the administration has multiple options to reimpose tariffs: Section 122 (15% for 150 days), Section 301 (national security), and Section 338 (up to 50% against discriminatory countries). We expect the weighted average tariff rate to remain near 90-year highs. With tariffs generating substantial revenue, they (ironically) support lower interest rates, which is favorable for equities from a valuation perspective.

- Shutdown looming | With 25 days until the current funding resolution expires on 9/30, betting markets give a 47% chance of a shutdown.

Our view: While government shutdowns add uncertainty, they’ve historically had no lasting impact on the economy or markets. Over the past 50 years, 20 shutdowns—ranging from 2 to 35 days—have left the S&P 500 flat, on average, from start to finish. Any volatility tends to be short-lived, with the S&P up ~13% on average over the next year and positive 80% of the time. That’s because fundamental drivers like GDP and earnings growth matter more. With recession risks unlikely and earnings still solid, any market turbulence from a shutdown should be brief.

- Tech rolling over | With Tech-related stocks being a major driver of the market’s gains, some recent softness and rotation to other sectors have prompted questions about Tech’s leadership going forward. Is Tech’s big run starting to wane?

Our view: Tech stocks—especially the MAGMAN* group—remain compelling for certain long-term investors as part of a diversified portfolio. As we mark the 30th anniversary of Cal Ripken Jr.’s legendary Iron Man streak, it’s fitting to compare Tech’s consistency, durability, and resilience to his record-setting run. Over the past three decades, Tech has been a consistent standout performer: up 3,668%, 2.5x stronger than the second-best performing sector on a price return basis. Tech’s gains have been driven by superior earnings growth—outpacing the S&P 500 in 23 of the last 30 years—and that momentum doesn’t appear to be slowing. Consensus estimates point to mega-cap Tech earnings continuing to run ahead of the rest of the S&P every quarter through 2026. With strong margins and cash flow, these companies can keep investing in the next big innovation while boosting buybacks and dividends.

All expressions of opinion reflect the judgment of the author(s) and the Investment Strategy Committee, and are subject to change. This information should not be construed as a recommendation. The foregoing content is subject to change at any time without notice. Content provided herein is for informational purposes only. There is no guarantee that these statements, opinions or forecasts provided herein will prove to be correct. Past performance is not a guarantee of future results. Indices and peer groups are not available for direct investment. Any investor who attempts to mimic the performance of an index or peer group would incur fees and expenses that would reduce returns. No investment strategy can guarantee success. Economic and market conditions are subject to change. Investing involves risks including the possible loss of capital.

The information has been obtained from sources considered to be reliable, but we do not guarantee that the foregoing material is accurate or complete. Diversification and asset allocation do not ensure a profit or protect against a loss.