2025 quick lookback & forward considerations

- 12.15.25

- Markets and Investing

- Commentary

Doug Drabik discusses fixed income market conditions and offers insight for bond investors.

We are getting close to the time when forecasts for next year will suggest how we should invest to optimize our portfolio. But wait – we are at that time when we should realize that last year’s forecasts weren’t exactly on target. In fairness, economic forecasts are difficult because of the enormous number of financial variables and the diverse, reactive behaviors of governments, corporations, and individuals. Fortunately, long-term fixed income planning does not rely on our predictive powers but rather on proper diversification, risk assessment, and maturity schedules that optimize cash flow and earnings potential for individual goals.

Key factors to the 2025 bond market

- Inflation remained in the headlines. Core Personal Consumption Expenditure (PCE) is the Federal Reserve’s preferred measure of inflation. After declining in March and April, PCE rose for four consecutive months and currently sits at 2.82% (September), higher than the Fed’s goal of 2.0%. The average PCE number since 2000 is 2.09%. The 2025 average is 2.8%.

- Market pundits have pointed out kinks in the employment data, noting, for example, weakness in nonfarm payroll data from May through August. September showed a significant reversal. Despite the few below-average months, the unemployment rate has remained remarkably in a favorable range. Unemployment rates between 4% and 6% are considered to be within the full employment range. The US Unemployment rate is currently at 4.4%.

- Gross Domestic Product (GDP) measures a country’s economic health, showing the market value of all goods and services produced. The US has fared well versus most economic powers, with a GDP of 2.1%. Although the economy is far from “running hot”, production remains modestly consistent.

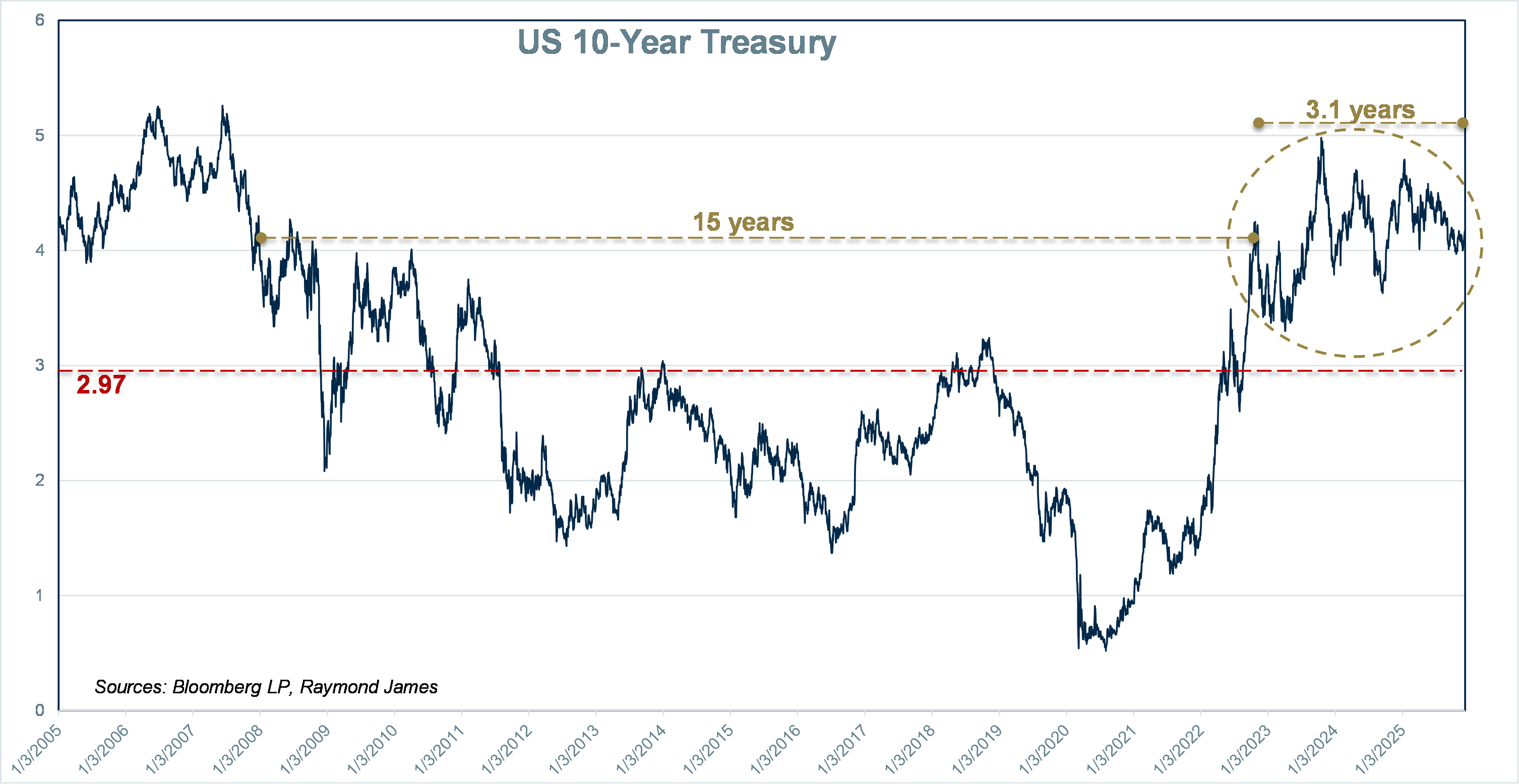

- Treasury rates remained little changed over the 20 to 30-year maturities. Rates were down by 40 to 70 basis points through 10 years in maturity. Many 2025 forecasts put the 10-year Treasury at ~5.0% (our forecast was ~4.25%). The 10-year Treasury is ~4.16% this morning on December 15. Note that although interest rates have declined slightly over the year, they remain elevated relative to the last two decades.

Key considerations for the bond market in 2026

- The Fed will likely be pulled in opposite directions as it tends to its dual mandate. Price stability is negatively influenced by inflation, and the Fed will likely stay diligent until it reaches the desired 2.0% target. Employment dips will be monitored closely, although, despite media hype, the unemployment level is currently in a good position.

- There is an argument that specific business sectors and particular consumers are already in a recessionary state, but that the remainder of industries and consumers are propping up the economy. Consumer spending will heavily influence how GDP holds up in 2026.

- As long as interest rates stay elevated, investors can secure known cash flows and benefit from income opportunities. It appears that although short-term rates may drop, the fixed income curves will remain steep, with the long end remaining stable or even rising. Steep curves reward clients with higher yields as maturities extend.

Still in play

- Extension swaps move bonds with shorter maturities into bonds with longer maturities. Since the short end of the curve is in demand, prices are high and yields low, thus investors are rewarded with healthy bids. Reinvestment further out on the curve can provide higher income, locking in and reducing reinvestment risk.

- It is not too late to harvest tax losses to offset gains achieved in stocks or any other asset.

- As short-term rates decrease, an opportunity exists to move money market funds or cash into the sweet spots of product curves, thus, like extension swaps, reducing reinvestment risk and locking into higher rates for longer.

- Rebalance portfolio allocations created by a third prosperous year in the stock market. This keeps risk in equilibrium and helps preserve accumulated wealth by positioning in less risky fixed income.

The author of this material is a Trader in the Fixed Income Department of Raymond James & Associates (RJA), and is not an Analyst. Any opinions expressed may differ from opinions expressed by other departments of RJA, including our Equity Research Department, and are subject to change without notice. The data and information contained herein was obtained from sources considered to be reliable, but RJA does not guarantee its accuracy and/or completeness. Neither the information nor any opinions expressed constitute a solicitation for the purchase or sale of any security referred to herein. This material may include analysis of sectors, securities and/or derivatives that RJA may have positions, long or short, held proprietarily. RJA or its affiliates may execute transactions which may not be consistent with the report’s conclusions. RJA may also have performed investment banking services for the issuers of such securities. Investors should discuss the risks inherent in bonds with their Raymond James Financial Advisor. Risks include, but are not limited to, changes in interest rates, liquidity, credit quality, volatility, and duration. Past performance is no assurance of future results.

Investment products are: not deposits, not FDIC/NCUA insured, not insured by any government agency, not bank guaranteed, subject to risk and may lose value.

To learn more about the risks and rewards of investing in fixed income, access the Financial Industry Regulatory Authority’s website at finra.org/investors/learn-to-invest/types-investments/bonds and the Municipal Securities Rulemaking Board’s (MSRB) Electronic Municipal Market Access System (EMMA) at emma.msrb.org.