More on the U.S. dollar: Still king in a shaky kingdom

- 10.10.25

- Economy & Policy

- Commentary

Chief Economist Eugenio J. Alemán discusses current economic conditions.

If you are an avid follower of our weekly write-ups, you know that we are rabid defenders of the U.S. dollar as the preeminent global currency. And before you get too far into this write-up, be sure to know that we are still very much in that camp. Our arguments over the years have been many. But probably the most important is this one: “In the land of the blind, the one-eyed man is king,” as nobody has shown an alternative currency that performs better over time than the U.S. dollar. Furthermore, as is the case with investment decisions, investors should look at the long game, and while the dollar has depreciated lately, it is still very strong compared to the early part of this century.

For those who argue that the move in favor of gold is a sign of the upcoming demise of the dollar, good luck trying to clip off a piece of your ingot to pay for goods and services. If you say you will not use gold to pay for goods and services, then that means that you will probably have to sell the gold back into the market and, probably, get dollars. Of course, some fans of crypto would argue that they will sell the gold for crypto and then pay with crypto for your goods and services. But why would you have to buy a ‘currency’ that costs so much to produce, is so expensive to acquire (or not!), and whose value is so volatile over time as crypto is?

The U.S. dollar has indeed depreciated at a time when it typically should have appreciated because, in investors’ minds, the dollar is less risky than other currencies in times of crisis. Furthermore, when tariffs are imposed, economic theory indicates that a country’s currency tends to appreciate, i.e., make the U.S. dollar stronger, rather than weaker.

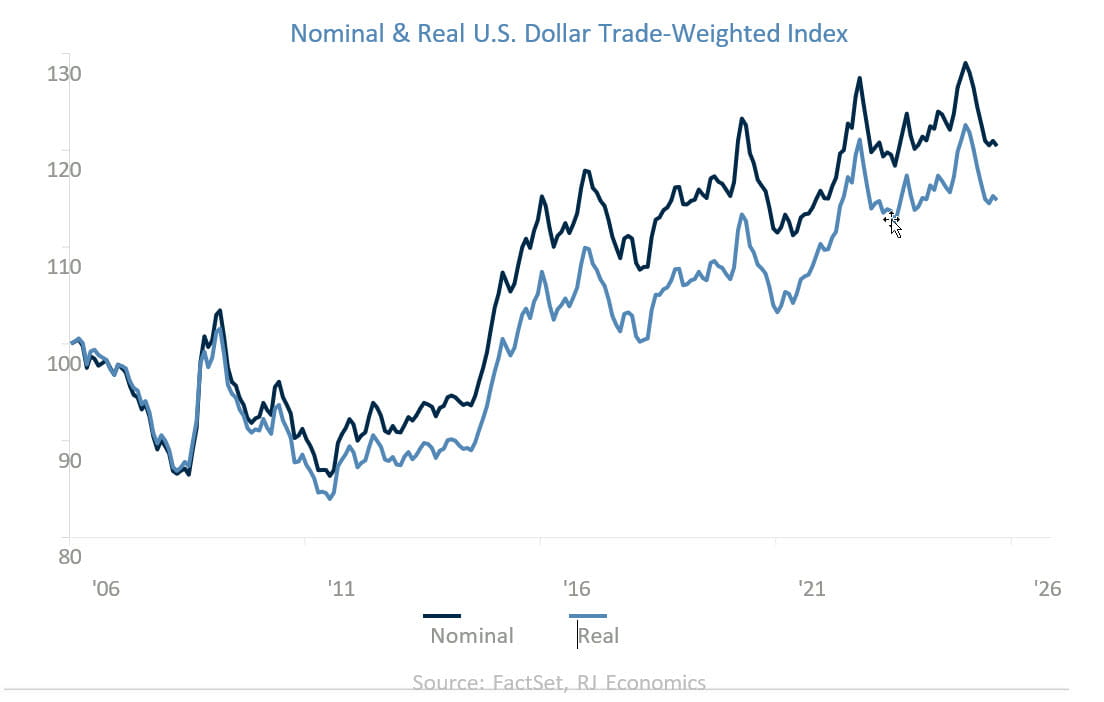

However, from the graph in the previous page, it is clear that the U.S. dollar had appreciated considerably, both in nominal as well as in real terms, since the late part of 2014, so it would not be strange to see some correction in the value of the dollar, even if we did not have a crisis. This is especially true with an administration that seems to prefer a weaker dollar. Does this mean that the dollar is about to fall apart? Does it mean that the dollar is losing favor with investors? Does it mean that the U.S. government is about to ditch the dollar and make us all poor?

We understand that there are lots of investors concerned with the value of the dollar. And yes, there is at least one new piece of research, from Steven B. Kamin, from the American Enterprise Institute, that seems to show that after Liberation Day, on April 2, “the dollar switched from being a safe-haven currency that appreciates in times of market volatility to a ‘risk-on’ currency that moves inversely with volatility.”1 This is, of course, concerning because there are relatively few currencies that are considered trustworthy around the world, and the U.S. dollar is the most important of them.

However, Kamin ended his research piece stating that “Most recently, the dollar’s sensitivity to the VIX (i.e., volatility) has retraced some of its earlier decline, but whether this signals a return to the dollar’s safe- haven status remains to be seen.”

The research paper makes good points and clearly shows that something was different after the April 2 Liberation Day. However, as the paper concludes, this may have only been a temporary event. At the same time, the dollar, as we have argued many times, has many more functions than being a less risky currency for investors. True, being a safe-haven currency is very important for remaining a reserve currency, but it is not the only important characteristic.

Furthermore, the current administration may be looking for a weaker dollar because it believes it is beneficial for the country’s ability to export. If this is the case, this is a new U.S. dollar policy compared to the last 40 years, when U.S. administrations promoted a “strong dollar policy.” Thus, it is no surprise that this may be helping in weakening the U.S. dollar, compared to the previous dollar policy.

However, in the grand scheme of things, and as the graph above shows, today’s U.S. dollar weakness pales compared to the value of the dollar as we approached the 2008 financial crisis.

So, in summary, are we still convinced that the U.S. dollar will remain the most important reserve currency for decades, and perhaps for generations to come? Yes.

Q: Will the U.S. dollar lose its preeminent place in the global economy someday in the future?

A: Maybe, but we won’t see it, and neither will our children, grandchildren, or even our great- grandchildren see that happening.

Q: Is losing its reserve currency status a serious issue?

A: Probably not. If you don’t believe us, ask any of your British friends how they have survived after the British pound lost its importance as the preeminent reserve currency.

Q: What are the real threats to U.S. dollar supremacy?

A: It is hopefully not the YouTube videos that try to sell doomsday, so you pull your U.S. dollar investments out so the person making it can collect ad fees from the YouTube videos and go on “living la vida loca”.

The real threats to U.S. dollar supremacy, in terms of importance, and according to our analysis, are:

- Lack of Federal Reserve independence

- Failure to keep inflation down and close to the target

- Not reducing the fiscal deficit to stabilize the growth rate of S. debt

- Continuous weaponization of the S. dollar in geopolitics

- Further central banks reserve diversification

- Trade and tariff policies

Economic and market conditions are subject to change.

Opinions are those of Investment Strategy and not necessarily those of Raymond James and are subject to change without notice. The information has been obtained from sources considered to be reliable, but we do not guarantee that the foregoing material is accurate or complete. There is no assurance any of the trends mentioned will continue or forecasts will occur. Past performance may not be indicative of future results.

Consumer Price Index is a measure of inflation compiled by the US Bureau of Labor Statistics. Currencies investing is generally considered speculative because of the significant potential for investment loss. Their markets are likely to be volatile and there may be sharp price fluctuations even during periods when prices overall are rising.

Consumer Sentiment is a consumer confidence index published monthly by the University of Michigan. The index is normalized to have a value of 100 in the first quarter of 1966. Each month at least 500 telephone interviews are conducted of a contiguous United States sample.

Personal Consumption Expenditures Price Index (PCE): The PCE is a measure of the prices that people living in the United States, or those buying on their behalf, pay for goods and services. The change in the PCE price index is known for capturing inflation (or deflation) across a wide range of consumer expenses and reflecting changes in consumer behavior.

The Consumer Confidence Index (CCI) is a survey, administered by The Conference Board, that measures how optimistic or pessimistic consumers are regarding their expected financial situation. A value above 100 signals a boost in the consumers’ confidence towards the future economic situation, as a consequence of which they are less prone to save, and more inclined to consume. The opposite applies to values under 100.

Certified Financial Planner Board of Standards Center for Financial Planning, Inc. owns and licenses the certification marks CFP®, CERTIFIED FINANCIAL PLANNER®, and CFP® (with plaque design) in the United States to Certified Financial Planner Board of Standards, Inc., which authorizes individuals who successfully complete the organization’s initial and ongoing certification requirements to use the certification marks.

Links are being provided for information purposes only. Raymond James is not affiliated with and does not endorse, authorize or sponsor any of the listed websites or their respective sponsors. Raymond James is not responsible for the content of any website or the collection or use of information regarding any website's users and/or members.

GDP Price Index: A measure of inflation in the prices of goods and services produced in the United States. The gross domestic product price index includes the prices of U.S. goods and services exported to other countries. The prices that Americans pay for imports aren't part of this index.

Employment cost Index: The Employment Cost Index (ECI) measures the change in the hourly labor cost to employers over time. The ECI uses a fixed “basket” of labor to produce a pure cost change, free from the effects of workers moving between occupations and industries and includes both the cost of wages and salaries and the cost of benefits.

US Dollar Index: The US Dollar Index is an index of the value of the United States dollar relative to a basket of foreign currencies, often referred to as a basket of U.S. trade partners' currencies. The Index goes up when the U.S. dollar gains "strength" when compared to other currencies.

The FHFA HPI is a broad measure of the movement of single-family house prices. The FHFA HPI is a weighted, repeat- sales index, meaning that it measures average price changes in repeat sales or refinancings on the same properties.

Import Price Index: The import price index measure price changes in goods or services purchased from abroad by U.S. residents (imports) and sold to foreign buyers (exports). The indexes are updated once a month by the Bureau of Labor Statistics (BLS) International Price Program (IPP).

ISM Services PMI Index: The Institute of Supply Management (ISM) Non-Manufacturing Purchasing Managers' Index (PMI) (also known as the ISM Services PMI) report on Business, a composite index is calculated as an indicator of the overall economic condition for the non-manufacturing sector.

The ISM Manufacturing Index: The GDP Now Institute of Supply Management (ISM) Manufacturing Measures the health of the manufacturing sector by surveying purchasing managers at manufacturing firms. The survey asks about current business conditions and expectations for the future, including new orders, inventories, employment, and deliveries.

Consumer Price Index (CPI) A consumer price index is a price index, the price of a weighted average market basket of consumer goods and services purchased by households.

Producer Price Index: A producer price index (PPI) is a price index that measures the average changes in prices received by domestic producers for their output.

Industrial production: Industrial production is a measure of output of the industrial sector of the economy. The industrial sector includes manufacturing, mining, and utilities. Although these sectors contribute only a small portion of gross domestic product, they are highly sensitive to interest rates and consumer demand.

The NAHB/Wells Fargo Housing Opportunity Index (HOI) for a given area is defined as the share of homes sold in that area that would have been affordable to a family earning the local median income, based on standard mortgage underwriting criteria.

Conference Board Coincident Economic Index: The Composite Index of Coincident Indicators is an index published by the Conference Board that provides a broad-based measurement of current economic conditions, helping economists, investors, and public policymakers to determine which phase of the business cycle the economy is currently experiencing.

Conference Board Lagging Economic Index: The Composite Index of Lagging Indicators is an index published monthly by the Conference Board, used to confirm and assess the direction of the economy's movements over recent months.

New Export Index: The PMI New export orders index allows us to track international demand for a country's goods and services on a timely, monthly, basis.

Gold is subject to the special risks associated with investing in precious metals, including but not limited to: price may be subject to wide fluctuation; the market is relatively limited; the sources are concentrated in countries that have the potential for instability; and the market is unregulated.

The Conference Board Leading Economic Index: Intended to forecast future economic activity, it is calculated from the values of ten key variables.

Source: FactSet, data as of 7/25/2025