Why the recent trade deals are important

- 07.25.25

- Markets & Investing

- Commentary

Review the latest Weekly Headings by CIO Larry Adam.

Key Takeaways

- Even with trade deals, nearly all country-level tariffs will be higher after August 1

- Diverging views at the Fed could lead to some fireworks at next week’s meeting

- Tariff impact on corporate earnings varies by sector – and tech is not immune

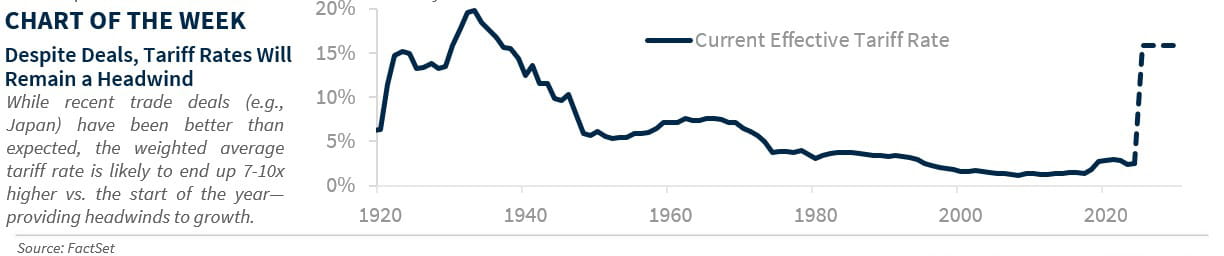

Let’s Make A Deal! With the August 1 trade deadline fast approaching, America’s trading partners are racing to finalize agreements in hopes of securing more favorable terms before the higher tariffs announced by President Trump take effect. This week’s trade deal with Japan sparked optimism that an agreement with the European Union could soon follow. Several country-specific tariffs have yet to be unveiled, along with potential sectoral tariffs on semiconductors and pharmaceuticals. While recent deals have brought some clarity after months of uncertainty—and there’s growing confidence that the worst-case scenario may be off the table—higher tariffs are still likely to exert pressure, pushing up prices and weighing on economic growth and corporate earnings. All of this is unfolding as global equity markets hit record highs, suggesting a degree of investor complacency. Today, we share our latest insights on trade policy and what it could mean for the economy, the Fed’s response, and the earnings outlook in the months ahead.

- Why Recent Trade Deals Are Important | With less than one week to go until the White House’s August 1 tariff deadline, the trade policy landscape remains mixed. The good news: trade deals are starting to take shape. So far, the US has inked six trade deals, which include China and Japan—two of America’s top five sources of imports—along with the UK, Vietnam, the Philippines, and Indonesia. Notably, the terms of the recent trade deals have been better than expected—with manageable tariff rates, pledges of increased access for US companies to our trading partners’ domestic markets, and commitments for direct investments into the US. The US is also in active talks with the EU—our #1 trading partner—and a deal over the next week feels within reach. While the EU is prepared to retaliate in the event of a no-deal outcome, both sides remain focused on a compromise. The bad news: practically all of the country-level tariffs that go into place after August 1 will be higher than the interim rates in place since April, and (on average) 7x higher than they were at the start of the year. This escalation will likely create headwinds for companies and consumers alike, as elevated costs ripple through supply chains in the second half of 2025 and into 2026. Below, we outline our updated views on the impact from tariffs:

- New Tax Law And Trade Deal Optimism Are Not Enough To Offset Tariff Impact On The Economy—Despite ongoing policy uncertainty and tariff-related headwinds, the US economy continues to show resilience. Real-time indicators—such as TSA screenings and restaurant bookings—suggest that consumers are still spending, while AI-driven investment remains a key driver of corporate capital expenditures. Optimism surrounding the new tax law and the recent trade agreement with Japan could serve as catalysts for growth, but their effects are unlikely to be immediate. For example, Japan’s pledge to purchase 100 Boeing aircraft and invest $550 billion in the US will take time to materialize. In the near term, higher tariff rates are expected to weigh on economic activity as businesses exhaust pre-tariff inventories and rising costs begin to filter through to consumers. Two key data points to watch next week: July job growth is expected to slow to a five-month low, and ISM Manufacturing is likely to remain in contraction for the fifth consecutive month.

- Fed Officials Are Grappling With How Tariffs Drive Inflation—As the Fed prepares for its July 29–30 meeting, the impact of tariffs and recent trade agreements will be a key focus of the policy debate. The challenge: policymakers remain divided on whether the effects of higher tariffs will be temporary or more persistent. In the June dot plot, seven of the 19 FOMC members projected no rate cuts in 2025, while eight expected two cuts this year, with the remaining voting for something else. This division may lead to one, if not two, FOMC members dissenting at the upcoming meeting—something that has not happened often. While some tariff pass-through is already evident in goods prices—particularly in categories like appliances, sporting goods, and toys—the overall impact has been modest so far. Still, with economic activity holding steady and inflationary pressures building in regional Fed surveys and ISM reports, the Fed has shown little inclination to cut rates preemptively. Importantly, tariffs are set to rise further after August 1, adding to the uncertainty. With limited visibility, the Fed is likely to maintain a cautious stance. As growth slows and tariff effects deepen, policy decisions will become increasingly complex.

- Tariff Headwinds For EPS Are Likely To Escalate In The Second Half—The 2Q25 earnings season is off to a solid start, with 86% of S&P 500 companies beating estimates thus far—which, if it holds, would mark the best on record. That said, consensus expects aggregate earnings to post the slowest growth since 4Q23—weighed down by tariff impacts. The sectors most exposed to tariffs (Consumer Discretionary, Materials) are on pace for the weakest earnings growth and have had the steepest downward revisions. For example, several major automakers highlighted multi-billion-dollar tariff costs, weighted more heavily to the second half of 2025. Overall, fundamentals remain narrow, with EPS growth led by mega-cap tech. Alphabet’s results reinforced strength in tech, with a composite of mega-cap tech on pace to grow earnings 15% YoY in 2Q, while the rest of the S&P 500 is expected to grow only 3%. Looking ahead, the upcoming sectoral tariffs on semis/electronics could pose headwinds for tech in the second half of 2025. With next week marking the busiest week of earnings season (~38% of market cap set to report), we will get more clarity on tariff-related impacts on earnings. As economic activity slows, we expect further downward revisions to the full-year consensus S&P 500 EPS estimate—from the current $262 toward $255.

All expressions of opinion reflect the judgment of the author(s) and the Investment Strategy Committee, and are subject to change. This information should not be construed as a recommendation. The foregoing content is subject to change at any time without notice. Content provided herein is for informational purposes only. There is no guarantee that these statements, opinions or forecasts provided herein will prove to be correct. Past performance is not a guarantee of future results. Indices and peer groups are not available for direct investment. Any investor who attempts to mimic the performance of an index or peer group would incur fees and expenses that would reduce returns. No investment strategy can guarantee success. Economic and market conditions are subject to change. Investing involves risks including the possible loss of capital.

The information has been obtained from sources considered to be reliable, but we do not guarantee that the foregoing material is accurate or complete. Diversification and asset allocation do not ensure a profit or protect against a loss.