What will the Fed’s December dot plot signal?

- 12.05.25

- Markets & Investing

- Commentary

Review the latest Weekly Headings by CIO Larry Adam.

Key takeaways

- President Trump signaled he has chosen Chair Powell’s successor

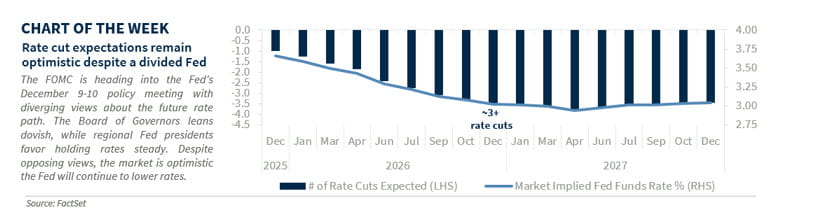

- Markets are leaning more dovish as investors bet on a more accommodative Fed

- Inflation remains sticky and could take longer to return to the Fed’s 2% target

The Fed’s final meeting of 2025, on December 9–10, is just around the corner, and expectations are running high. Markets are assuming a third consecutive rate cut as signs of labor market weakness persist. Yet, beneath that near certainty lies an unusual public split within the FOMC. Recent dissents highlight the challenge of balancing a cooling job market against stubborn inflation—casting fresh uncertainty over the policy path for 2026. Adding to the intrigue is a looming leadership transition: Chair Jerome Powell’s term ends in May 2026, and the search for his successor is already underway. President Donald Trump has hinted that his choice is made and will be announced in early January. Below we preview the leading contender, Kevin Hassett, for the Fed’s top job, break down what to watch in the updated dot plot and economic projections, and explore what it all means for equity and fixed income markets.

Trump signals his pick for the next Fed chair: President Trump has confirmed that he’s chosen Powell’s successor when Powell’s term ends in May 2026—and many signs point to Kevin Hassett, director of the National Economic Council, as the front-runner. Betting markets now place Hassett’s odds above 70%. With no vacant seats on the Fed—Powell’s Board term runs through 2028, and Governor Cook’s legal case unresolved—Trump would likely nominate Hassett to Stephen Miran’s seat, which expires at the end of January 2026. Of course, the Senate must still approve the nomination. Hassett’s close ties to Trump have sparked concerns that he could push for sharply lower interest rates, potentially challenging the Fed’s independence and stoking inflation. We see those risks as limited. Why? While Hassett shares many of Trump’s economic views, the Fed chair is only one of 12 votes on the Federal Open Markets Committee. Whoever takes the helm will likely act responsibly to preserve the institution’s independence and avoid political interference.

The Fed faces data gaps ahead of December’s meeting: With official government reports delayed by the shutdown, the Fed will head into next week’s meeting without its usual full data set. Still, private-sector indicators and anecdotal evidence paint a clear picture: labor market weakness persists (ADP and ISM employment metrics), while inflation pressures are building (Truflation and ISM Prices indices). Despite the uncertainty, the economy’s resilience—fueled by AI-driven capex spending and relatively muted tariff impacts so far—should prompt the Fed to upgrade its growth outlook. We expect the Fed’s 2025 GDP forecasts to rise from 1.6% to 1.8%, with 2026 ticking up from 1.8% to 2.0%, supported by easier financial conditions and fiscal stimulus from the One Big Beautiful Bill Act. The risk? Inflation remains elevated and sticky and could take longer to return to the Fed’s 2% target—keeping policy uncertainty elevated well into 2026.

A hawkish 25 basis point cut, but a divided Fed: A 25 basis point rate cut at next week’s Fed meeting is all but certain—but don’t expect a unanimous vote. Recent dissents and diverging views point to an updated dot plot that will show an even wider dispersion, continuing a trend seen in recent years. In September’s projections, the median dot signaled just one more cut in 2026 and a return to neutral—around 3.0%—over the forecast horizon. We don’t anticipate major changes to that median view, but the growing gap between market pricing and the Fed’s expected rate path is a risk worth watching. Markets are leaning more dovish, pricing in nearly 60 basis points of additional cuts in 2026, as investors bet on a more accommodative Fed—especially with Hassett now the clear favorite to succeed Powell. Expect Powell’s press conference to frame next week’s move as a “hawkish cut,” emphasizing caution and “data dependence” even as rates come down.

Asset class views: Below, we outline what the Fed’s changing leadership and updated projections could mean for the markets.

- Equities: Diverging views within the Fed mean policy uncertainty will likely stay elevated. Still, near-term rate path concerns aren’t expected to materially sway equities—especially with economic growth set to improve in 2026, a tailwind for earnings in the year ahead. That said, valuations remain historically stretched (the S&P 500 P/E multiple sits in the 96th percentile), and a wave of delayed government data arriving in the coming weeks could spark volatility if results disappoint—like signs of higher inflation. Any pullbacks, however, should prove short-lived if the economic backdrop strengthens as we anticipate.

- Fixed Income: Next week’s expected 25 basis point “hawkish cut” should keep the Treasury yield curve’s recent steepening bias intact. Continued Fed easing will likely anchor short-term yields (up to 2 years), while longer maturities—10-year and beyond—drift higher as growth prospects improve and inflation stays sticky. The odds of the 10-year Treasury yield falling sustainably below 4% remain low outside a recession—a scenario we view as unlikely. The bigger risk? If the incoming Fed chair signals a deeper rate-cutting cycle than fundamentals justify, inflation expectations could quickly become unanchored as the economy runs “hot,” pushing long-term yields even higher. To do this, Hassett would need to build consensus at the FOMC, not an easy task given current divisions on the FOMC.

All expressions of opinion reflect the judgment of the author(s) and the Investment Strategy Committee and are subject to change. This information should not be construed as a recommendation. The foregoing content is subject to change at any time without notice. Content provided herein is for informational purposes only. There is no guarantee that these statements, opinions or forecasts provided herein will prove to be correct. Past performance is not a guarantee of future results. Indices and peer groups are not available for direct investment. Any investor who attempts to mimic the performance of an index or peer group would incur fees and expenses that would reduce returns. No investment strategy can guarantee success. Economic and market conditions are subject to change. Investing involves risks including the possible loss of capital.

The information has been obtained from sources considered to be reliable, but we do not guarantee that the foregoing material is accurate or complete. Diversification and asset allocation do not ensure a profit or protect against a loss.