A strong economy, but few feel the benefits

- 01.23.26

- Economy & Policy

- Commentary

Raymond James Chief Economist Eugenio J. Alemán discusses current economic conditions.

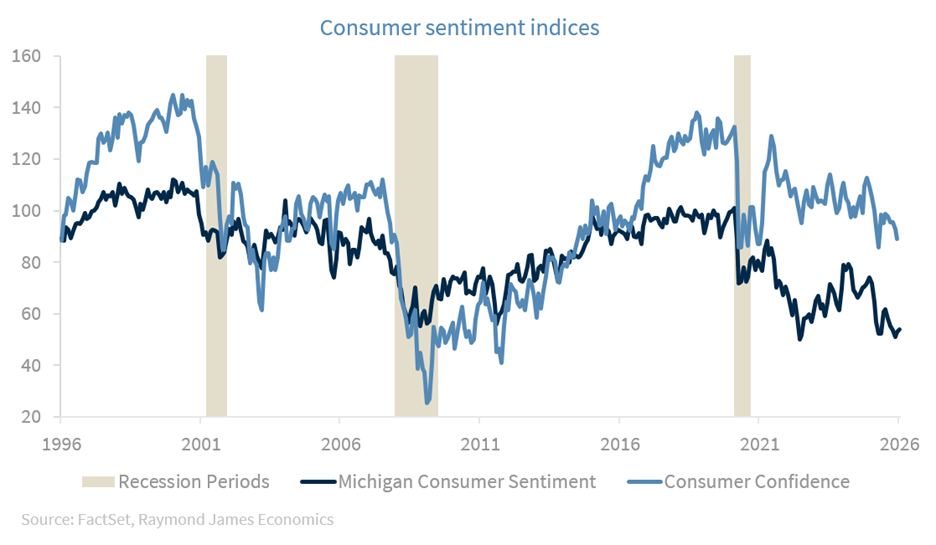

Americans are in a very similar environment today as during the Biden administration in terms of the existing mismatch between the strength in economic activity, on the one hand, and the failure of consumers to feel good about it, as reflected by consumer confidence as well as consumer sentiment indices (graph below). This points to a fundamental detachment between the economy and the benefits accruing to individuals and households, something that will keep politicians guessing and is typically not a good omen for incumbents, especially during a midterm election year. But we are not political analysts so we will skip any potential political consequences from this mismatch.

Both the Consumer Confidence and the Consumer Sentiment indices are low today, with the Consumer Sentiment Index recording its second lowest ever reading in November 2025, while the Consumer Confidence Index is not as low, but it is close to the levels recorded during the pandemic recession. A lot has been said over the last several years about consumer strength being driven by the top or high earners (and high financial wealth holders) while mid-to-low income households continue to struggle. But there is another group of households that is also driving consumption in this economy, and its impact is not small.

We are talking about retirees. But not all retirees. We are talking about retirees with 401(k)s and IRAs, which have reaped the benefits of strong market returns over the last several years.

An anecdote will help make this point. During a conversation with friends, a couple who have been retired for 10 years, we asked what their biggest concern was 10 years into retirement. To our surprise, the couple indicated that they were concerned with how much taxes they will have to pay due to large required minimum distributions (RMD). Of course, this is nothing new; there are many retirees, especially high-income retirees, who have been concerned with RMDs, and they continue to work with advisors to try to reduce those concerns.

Let’s call this group the ‘remain invested couple-household’ (RIC-H)

What surprised us was that this was not a “rich” couple; they are a somewhat middle-income couple who planned conservatively and have continued to remain invested, with a relatively large allocation to equities, or what we are calling “RIC-H.” But their commentary struck us because they said that they have almost the same amount of savings they had 10 years ago and are concerned that they will have to pay more in taxes than they had previously estimated. They have been moving money through Roth conversions, but that has not been enough to make their potential tax bill lower.

This is a very good thing to be concerned with, of course. They had originally planned one or two trips plus one cruise per year, but they are now taking four cruises per year and more than two non-cruise trips as they continue to try to spend more than originally planned. However, even that has not been enough.

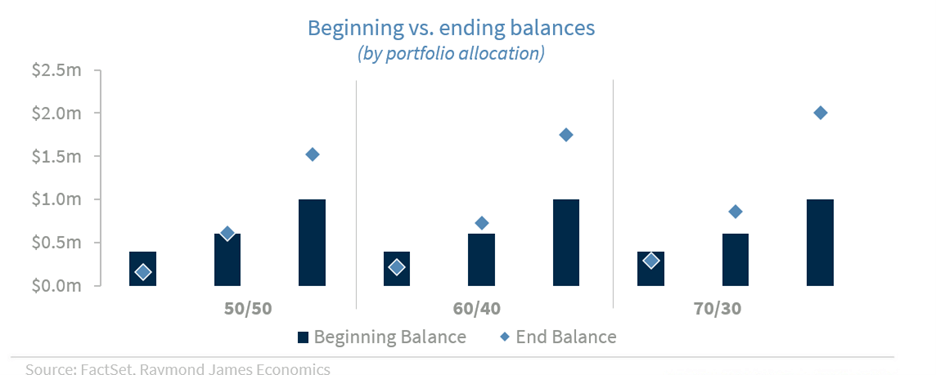

If we look at a simple 50/50 portfolio in 2016, without annual rebalancing, and assume a steady $50,000 annual withdrawal, the picture today is far better than many would have expected a decade ago. Thanks to a strong market cycle, most notably the performance of US equities, retirees who began 2016 with at least $600,000 in savings would still have slightly more money today, even after 10 years of withdrawals. A household that started with $1 million would now be sitting on roughly $500,000 more than they began with.

Why? Because the market environment since 2016 has been extraordinarily favorable. The S&P 500 delivered a cumulative total return of about 300% over the period, meaning $100 invested in early 2016 grew to roughly $400 by 2026, dividends reinvested, equivalent to an annualized return of roughly 15%.

Of course, every retiree’s experience is different. Allocations vary, withdrawal needs differ, and some households rebalance regularly while others don't. Bond returns were more mixed, including a historically difficult 2022 for fixed income, but the dominant force was equity appreciation. In fact, as shown in the chart below, retirees with portfolios with higher exposure to equities experienced even higher returns.

The broader takeaway is this: Households entering retirement in 2016 likely ended up in far stronger financial shape than they anticipated. The decade-long equity rally not only offset withdrawals for many investors, but it also actually expanded their nest eggs in numerous cases. This stands in sharp contrast to the more conservative expectations many retirees held at the beginning of the period, when average return assumptions were significantly lower.

If we consider that 47%-54% of households aged 65 and older held retirement accounts in 2022, while 70% of households 70 years and older held retirement accounts, it is no wonder that sectors like travel, leisure, and hospitality, etc., have continued to do well even in an environment where employment growth has slowed down to a trickle.

These retirees do not depend on income from employment; they depend on income from accumulated wealth, and that source of income for retirees who hold retirement accounts is the income coming from accumulated wealth to the RIC-H, which is alive and well.

There is even good news for our fiscal accounts also. If our RIC-H couple is representative of those who are retired, then fiscal revenues over the next several decades may be much higher than expected, which is good news for the US fiscal deficit.

Economic and market conditions are subject to change.

Opinions are those of Investment Strategy and not necessarily those of Raymond James and are subject to change without notice. The information has been obtained from sources considered to be reliable, but we do not guarantee that the foregoing material is accurate or complete. There is no assurance any of the trends mentioned will continue or forecasts will occur. Past performance may not be indicative of future results.

Economic and market conditions are subject to change.

Opinions are those of Investment Strategy and not necessarily those of Raymond James and are subject to change without notice. The information has been obtained from sources considered to be reliable, but we do not guarantee that the foregoing material is accurate or complete. There is no assurance any of the trends mentioned will continue or forecasts will occur. Past performance may not be indicative of future results.