Anchoring bias

Drew O’Neil discusses fixed income market conditions and offers insight for bond investors.

As investors, unfortunately, we do not dictate the price at which we purchase an investment from the marketplace. As we know, the opposite is true: the market determines the price. We can wish all day for the market to let us purchase shares of Amazon stock at $10/share, but no matter how much we want it, buying at that price may not be an option that is available today. It has been a long time since Amazon traded close to $10/share, and it is currently trading at over 20 times that level. Does this mean that investing in Amazon at its current price is not a good idea, and you should wait until it drops back down to $10 before considering an investment? Probably not; Amazon may never drop down to that price. If Amazon stock fits into your overall allocation and long-term plan, then purchasing at today’s price can still make sense.

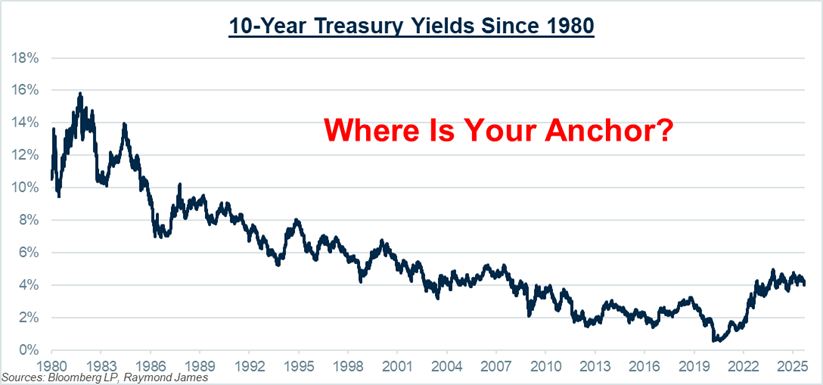

The same logic applies to investing in fixed income. You might have memories of the 10-year Treasury yielding over 8% back in 1995 or perhaps over 10% in 1985. Or a 4.75% yield from the start of 2025 is what comes to mind as an appropriate yield. Yet, remembering that these yields were once available does not mean that you should wait until yields return to these levels before investing in fixed income. Could 10-year Treasury yields move back to these levels at some point in the future? Sure, but it is also possible that we don’t see those yields again for a very long time, if ever. Regardless of what you consider “normal” yield levels, there is no certainty as to when or if those yields will return.

Viewing current price or yield levels and making a judgment of value based on what we considered a “normal” level in the past is referred to in psychology as an anchoring bias, meaning that our minds are “anchored” to the past value and use it as a benchmark to determine value. Every investor will have a different “anchor” for interest rates. This is commonly tied to some point in the past that our minds are anchored to but could also be linked to what “experts” claim is a normal level for interest rates.

While yields have fallen somewhat over the past few months, across most of the fixed income market they are still at more attractive levels than we have experienced for most of the past 15+ years. To provide some context, the 10-year Treasury yield is currently over 150 basis points higher than its average over the past 15 years (4.13% versus an average of 2.55%). The municipal market tells a similar story as the 30-year AAA municipal yield is over 100 basis points higher than its average over that timeframe (4.17% versus an average of 3.05%). While we may not be at the recent peak of interest rates, yields are still at very attractive levels from a historical perspective.

When deciding what to invest in and when to invest, investors are oftentimes letting mental anchors guide their decisions, which can be less than optimal. It is easy to let this mentality lead to allocating money that should be allocated to fixed income into other asset classes because, as the investor, we want to wait until yields return to perceived normal levels. These normal levels may never return, which could lead to a chronic overallocation into riskier assets. It is important to remember that each asset class serves a distinct purpose within a portfolio. Fixed income is often meant to be the stable ballast that a portfolio is structured around, focused on consistent income, cash flow, and return of principal (not necessarily return on principal); something that fixed income substitutes often struggle to replicate.

A prudent investor should look around at the current landscape and assess where the best value is and determine how to best take advantage of the situation to help reach one’s long-term goals. Instead of waiting and trying to predict when yields will return back to desired levels, investors should be asking more useful questions. Taxable or municipal bonds? Where should I position on the yield curve? What are my liquidity needs? What is my risk tolerance? What is the long-term goal for my portfolio? Answering these questions can be much more productive than letting your brain be pulled on by an anchoring bias and wishing things were like the good ole days.

The author of this material is a Trader in the Fixed Income Department of Raymond James & Associates (RJA), and is not an Analyst. Any opinions expressed may differ from opinions expressed by other departments of RJA, including our Equity Research Department, and are subject to change without notice. The data and information contained herein was obtained from sources considered to be reliable, but RJA does not guarantee its accuracy and/or completeness. Neither the information nor any opinions expressed constitute a solicitation for the purchase or sale of any security referred to herein. This material may include analysis of sectors, securities and/or derivatives that RJA may have positions, long or short, held proprietarily. RJA or its affiliates may execute transactions which may not be consistent with the report’s conclusions. RJA may also have performed investment banking services for the issuers of such securities. Investors should discuss the risks inherent in bonds with their Raymond James Financial Advisor. Risks include, but are not limited to, changes in interest rates, liquidity, credit quality, volatility, and duration. Past performance is no assurance of future results.

Investment products are: not deposits, not FDIC/NCUA insured, not insured by any government agency, not bank guaranteed, subject to risk and may lose value.

To learn more about the risks and rewards of investing in fixed income, access the Financial Industry Regulatory Authority’s website at finra.org/investors/learn-to-invest/types-investments/bonds and the Municipal Securities Rulemaking Board’s (MSRB) Electronic Municipal Market Access System (EMMA) at emma.msrb.org.