Sustainable investing, an approach that integrates environmental, social and governance (ESG) criteria, is becoming a much sought-after strategy in the financial industry. Whether implemented through socially responsible investing (SRI) screening, ESG integration or impact investing, sustainable investing offers a growing number of options for investors interested in achieving goals beyond financial growth when building their portfolios.

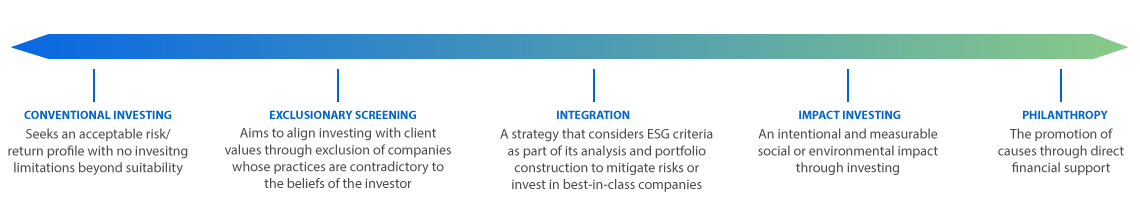

Whereas conventional investing is focused on risk/return, and philanthropy seeks solely to benefit charities and causes without return or income consideration, sustainable investing looks to accomplish both in varying degrees along a spectrum of possible outcomes.

The paths to achieving effective global stewardship and possible growth are coming together in the investor mindset. Sustainable investing, when incorporated into a well-defined, long-term investment plan, can be a powerful tool in addressing global challenges while achieving personal financial goals.

Investors may consider sustainable investing for a host of reasons:

- Risk mitigation

- More conscious approach to investing

- Long-term performance

- Align investing with personal or religious views

- Fiduciary duty

What are the approaches?

While there is a common theme of pursuing a greater purpose, there is much variety within sustainable investment strategies, particularly in how they are implemented. Implementation generally takes the form of one or more of the following approaches:

Exclusionary Screening

- Viewed as the original approach to “responsible” investing

- Also known as socially responsible investing or negative screening

- Excludes individual companies or entire industries from portfolios if their activities conflict with an investor’s values, such as fossil-fuels, gambling or alcohol

- Limits investable universe, which could impact diversification

Impact Investing

- Aims to have a social or environmental impact alongside financial return, with a focus on intentionality and measurement of impact

- Ranges from grant support to private equity; liquidity risk and return target can vary dramatically

- Most common products are funds invested in private equity and venture capital

- Accredited investors and funds are the leaders in impact investment by asset level

Global Impact Investing Network, “What You Need to Know About Impact Investing,” https://thegiin.org/impact-investing/need-to-know/#s2

Integration

- Combines ESG criteria with traditional financial considerations

- Gaining momentum as portfolio managers consider ESG themes in their decision-making process

- Sometimes implemented as a best-in-class approach by identifying and investing in companies that are the best ESG performers within a sector or industry group

- A study conducted by the CFA Institute cites integration is the most commonly used method1

1CFA Institute, “ESG Issues in Investing: Investors Debunk the Myths.” 2015

Other Dimensions

- Thematic investing – focuses on a specific ESG theme, and structures a portfolio around companies or industries that support that theme

- Shareholder engagement (activism) – actively engages with a company, directly working with management or exercising shareholder rights to effect change

Investing involves risk and you may incur a profit or loss regardless of strategy selected, including diversification and asset allocation.